- Aviva’s Freight Liability product is now newly available to brokers on Acturis E-Trade and refreshed on Fast Trade.

- Enhancements include a broader range of conditions of carriage and the introduction of a lower-cost ‘economy’ cover option.

- These updates are part of a wider digital transformation within Aviva’s Marine insurance team.

- Aviva has also expanded its Digital Marine team with three new underwriters, creating one of the UK’s largest Cargo and Freight Liability underwriting teams.

- The enhancements support Aviva’s Global, Corporate & Specialty business in its strategic goals of becoming a market-leading, dual-platform specialty insurer.

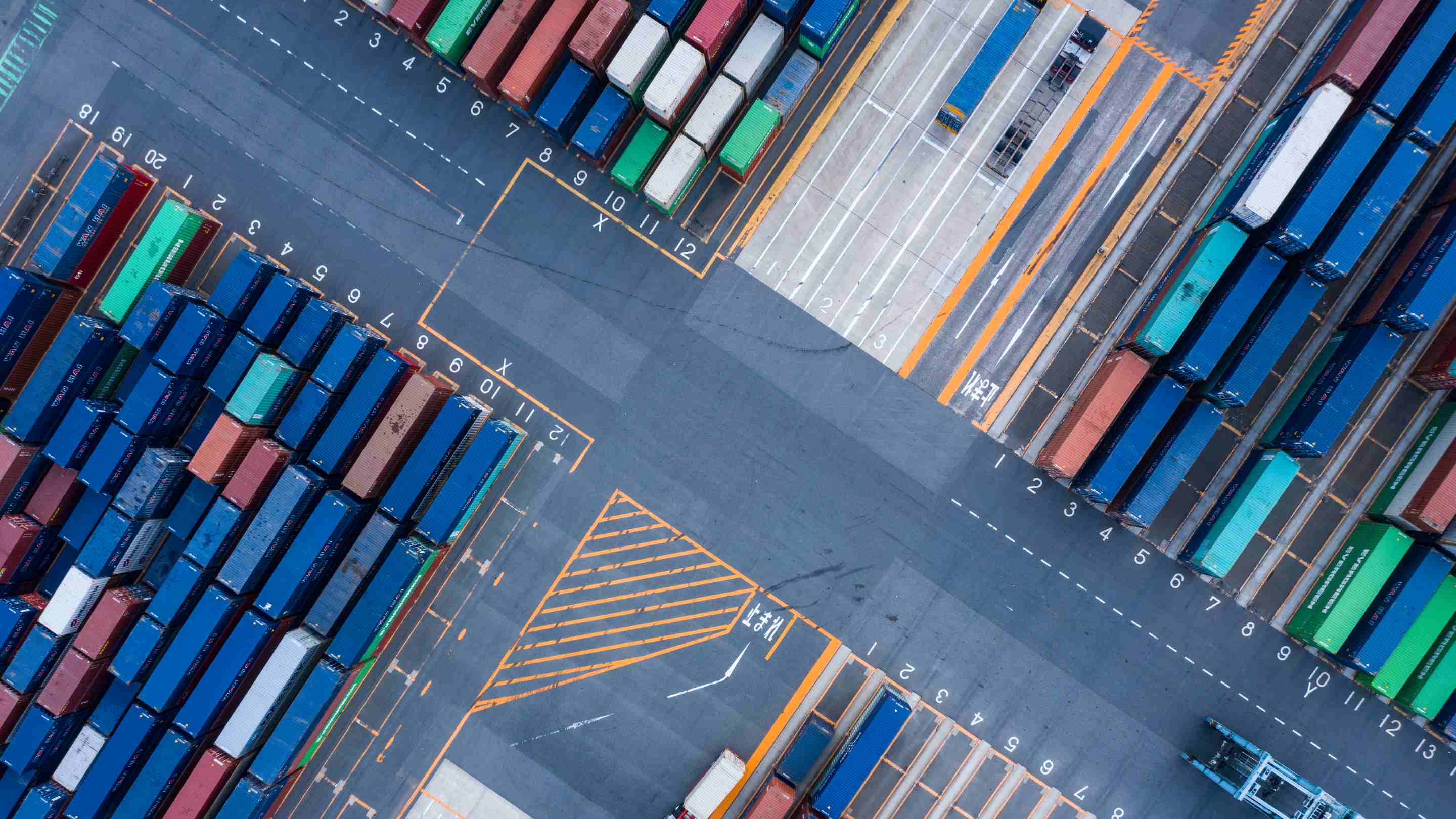

Aviva’s Global, Corporate and Specialty (GCS) business has introduced its enhanced Freight Liability insurance to the market, with the updated product newly available on Acturis E-Trade and Fast Trade platforms.

The updated proposition now offers greater flexibility to meet the evolving needs of brokers and clients. Key enhancements include increased cover limits, a broader range of conditions of carriage - offering greater flexibility for freight forwarders and hauliers – and the introduction of a lower-cost ‘economy’ cover.

These improvements form part of a wider digital transformation journey within Aviva’s Marine team, aimed at modernising Freight insurance and delivering faster, smarter solutions for the market.

Other key updates to the Freight Liability product include:

- Increased cover limits per tonne and per vehicle, with flexible options based on conditions of carriage and turnover - designed to better support a wider variety of business models and client risk needs.

- Expanded selection of conditions of carriage, including Logistics UK and The British International Freight Association (BIFA) for freight forwarders.

- New lower-cost ‘economy’ cover option for clients not involved in Theft Attractive Goods*, offering a more cost-effective solution.

- Optional Errors and Omissions cover available online, eliminating the need for referrals.

Alongside the product enhancement, Aviva’s Digital team also continues to grow, with the appointment of three new Marine Underwriters. This ongoing investment in talent and expertise means Aviva’s Marine team has more than doubled in size over the past seven years and now operates on a national scale.

These developments further support the strategic ambitions of Aviva’s GCS business, as it accelerates toward becoming a market-leading, dual-platform specialty insurer.

Chris Green, UK Marine Manager at Aviva, said:

"Marine insurance may be centuries old, but it shouldn’t stay stuck in the past. For years, brokers have asked for a digital Freight Liability solution that goes beyond the traditional 5–10 vehicle model. At Aviva, we’ve listened, and we’re committed to modernising how we trade and support our brokers and clients.

These exciting enhancements reflect our ongoing commitment to strengthening our Marine proposition and building a five-star digital trading experience. They help us set the standard in digital trading and make it easier than ever to do business with Aviva.

“We’ve invested in making our Cargo and Freight Liability propositions more accessible, flexible and responsive to today’s needs. That includes enhanced cover limits, broader carriage condition options, and a new lower cost ‘economy’ tier for clients not handling Theft Attractive Goods.

“We’ve also grown our team significantly to ensure we can support brokers with both digital and traditional trading. Now with one of the UK’s largest Cargo and Freight Liability underwriting teams behind us, we’re ready to help brokers trade their way - online or offline - with confidence and ease.”

Howard Potter, Head of Marine at Aviva, added:

“Aviva’s ambition is to lead the Marine insurance market by combining deep technical expertise with a clear understanding of what brokers and clients need. Alongside evolving our products, we’re transforming how we work, how we connect and how we deliver value.

“These exciting enhancements reflect our ongoing commitment to strengthening our Marine proposition and building a five-star digital trading experience. They help us set the standard in digital trading and make it easier than ever to do business with Aviva.

“These changes also support the broader strategic goals of Aviva’s Global, Corporate & Specialty business, as we accelerate toward becoming a market-leading, dual-platform specialty insurer.”

-ends-

Media enquiries:

Karmen Ivey

General Insurance — GCS (Global, Corporate and Specialty), Heritage

-

Phone

-

+44 (0) 7385 013 292

-

-

Email

Notes to editors:

* Theft Attractive Goods includes:

- Wines and/or spirits including but not limited to champagne;

- Cigars, cigarettes and tobacco excluding raw leaf tobacco;

- Non-ferrous metals in raw scrap bar or ingot or similar form;

- Footwear, clothing, furs, leathers and readymade garments;

- Mobile phones and/or smart phones and/or wireless communication devices;

- Precious stones or precious metals or articles made of or containing precious stones or metals;

- Audio/visual equipment;

- Satellite navigation equipment;

- Computer equipment, software, hardware (excluding loss of data where no cover shall apply) and accessories;

- Photographic equipment and accessories;

- Bottled perfumery and cosmetics;

- Watches and jewellery

Notes to editors:

- We are the UK's only diversified insurer and we operate in the UK, Ireland and Canada. We also have international investments in India and China.

- We help our 25.2 million customers make the most out of life, plan for the future, and have the confidence that if things go wrong we’ll be there to put it right.

- We have been taking care of people for more than 325 years, in line with our purpose of being ‘with you today, for a better tomorrow’. In 2025, we paid £31.9 billion in claims and benefits to our customers.

- Aviva is a Living Wage, Living Pension and Living Hours employer and provides market-leading benefits for our people, including flexible working, paid carers leave and equal parental leave. Find out more at www.aviva.com/about-us/our-people/

- As at 31 December 2025, total Group assets under management at Aviva Group were £454 billion and our estimated Solvency II shareholder capital surplus was £7.1 billion. Our shares are listed on the London Stock Exchange and we are a member of the FTSE 100 index.

- For more details on what we do, our business and how we help our customers, visit www.aviva.com/about-us

- The Aviva newsroom at www.aviva.com/newsroom includes links to our spokespeople images, podcasts, research reports and our news release archive. Sign up to get the latest news from Aviva by email.

- You can follow us on:

- X: www.x.com/avivaplc

- LinkedIn: www.linkedin.com/company/aviva-plc

- Instagram: www.instagram.com/avivaplc/

- For the latest corporate films from around our business, subscribe to our YouTube channel: www.youtube.com/aviva